As wealth management firms aim to streamline their documentation processes, it’s important for advisors to keep track of the most recent updates to the software and CRM tools that enable their day-to-day work.

In a recent joint webinar, Docupace’s Kevin Johannesen, VP of Client Solutions, and Wealthbox’s Chris Kopanski, Senior Product Specialist, teamed up to discuss how recent updates to the Docupace and Wealthbox integration are making it even easier for advisors to access key information in both platforms.

In this blog, we explain how Docupace and Wealthbox work, the current digital landscape where Docupace and Wealthbox fit, and the two integration updates that were recently launched.

Understanding Wealthbox & Docupace

Wealthbox is one of the industry’s top CRM (customer relationship management) tools designed specifically for wealth management companies. Wealthbox’s features help financial advisors keep track of daily tasks, communications, and past interactions so they can provide the best service possible.

Docupace is a comprehensive digital operations solution that provides the following and more:

- Universal account onboarding with straight through processing

- Automated document management

- Concierge advisor transitions

- Electronic disclosure delivery

In addition, Docupace’s platform is an industry leader in helping advisors stay compliant with Form CRS, Reg BI, and other disclosures. Docupace reduces the costs of physical delivery by helping advisors go paperless.

Understanding the CRM & Document Management Ecosystem

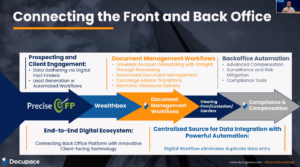

Think of Wealthbox as a digital personal assistant to help with day-to-day task management. Docupace then uses client information stored in Wealthbox to automate documentation tasks and create a centralized source for data integration.

Working together, these tools work together to create an end-to-end workflow where tedious tasks are automated, and information is stored in one compliant place. Along with other tools like PreciseFP, Docupace and Wealthbox provide an end-to-end digital ecosystem with innovative client-facing technology.

The ability to gather information from clients, execute signing and approvals, and stay organized all within one compliant platform is a huge win for registered broker dealers and investment advisors. It’s secure, approved, and indexes all the document/approval history that financial advisors need.

Not only that, but Docupace and Wealthbox offer integrations that make meeting customer needs and keeping up with documentation tasks even easier. For example, a financial advisor can access their client record page in Wealthbox with all their contact details, and then directly input that information into documents with Docupace.

New Wealthbox & Docupace Integrations

What are the latest integrations from the Wealthbox and Docupace teams? On the Wealthbox platform, under Contact Details, advisors can now select the “send to” option and directly send that customer’s information to the form of their choosing in Docupace.

This happens in two ways:

- Client Folder: This option allows advisors to automatically pull up the folder and subfolders of Docupace documents associated with this client in one simple click, as well as populate the information for the single client into new forms already stored in Docupace.

- Starting Point: This option allows advisors to tie other people from the household (spouse, children), to the same document as the client, or “starting point.” This is especially helpful and reduces redundancies for use cases like adding children as beneficiaries to an IRA, or adding other adults for a joint account.

This new integration also includes perks like automated indexing and eSign capabilities and integrations for signatures so you can easily send off documents to their next step. Additionally, when information is pulled from Wealthbox, Docupace has required validations that ensure information is pulled over correctly and no information is missing.

In summary, there is now a SSO link from Wealthbox that can look up all of the documents that have been indexed into Docupace for a client. Those documents are all stored in a single system that then enables advisors to take next steps, is fully compliant, and also keeps track of all past transactions so nothing falls through the cracks.

As Johannesen said on the webinar, “We do all the heavy lifting.” Docupace and Wealthbox’s new integrations allows financial advisors to easily go from one to the other to fully maximize the benefits of their digital ecosystem.

If you’re interested in learning more about integrations with Docupace, reach out to our experts directly at communications@docupace.com to learn about the solutions we have for your specific needs. You can also watch the full webinar here.