When marketing your wealth management firm to the world, one may think appealing to the broadest market makes sense. Everyone is a potential client, so why limit yourself right? Well unlike Cady Heron and her Mathletes, this limit does exist.

World-renowned marketing guru Seth Godin famously once said: “If you market to everyone, you’re marketing to no one.”

When you tailor your messaging and services to a specific audience, it offers unique advantages to both your firm and your clients. Specializing in one particular target makes you the expert at catering to that population. These can be trade-based such as “dentists” or “small business owners” or even super-specific like “military fighter pilots” or “women business founders” (all of which I’ve come across in my career).

You understand their unique needs. You can dive deeply into the products and services that help your clients the most, and you don’t have to compete with larger firms’ tools, experiences, and budgets. You can build trust with clients because you have the resources to become deeply relevant to a select group of people, and many clients are willing to pay for that level of expertise.

In today’s market, specialization is now the most popular approach for financial advisors. CEG Advisors reports that 70% of top advisors focus on niche clients. When you concentrate on a particular group of clients, you join a growing number of financial advising specialists.

If your firm is considering a tackling a new niche or in need of a reset, there are some key considerations to help you start that process.

How to Find the Best Specialization Strategy for Your Firm

Here are few potential markets to consider:

Age Groups

Many firms consider near-retirees to be their ideal clients, leaving many large, important groups generally overlooked by the market. Generation X (Age 43-58) is a perfect example of this phenomenon right now. While the majority of the press, excitement and experts are focused on teach advisors how to attract Millennials (Age 27-42), Gen X sits on more assets ($29.6 trillion vs. $27.5 trillion), is squarely in peak earnings years and is much closer to retirement.

Speaking of Millennials, how about carving a niche for young parents beginning the process of getting “serious” about financial planning and could use help from a professional.

Professions

Whether you target educators, farmers, doctors, trade professionals, artists, or civil servants, you can quickly become an expert when you focus on a specific group. Your clients will appreciate your easy grasp of the challenges and resources available to members of their profession. For example, civil servants can access government programs that can provide benefits, discounts, and financial assistance.

One place to start is to look at your current client base. It’s likely you already have several common threads woven through your client book.

Hobbies and Special Interests

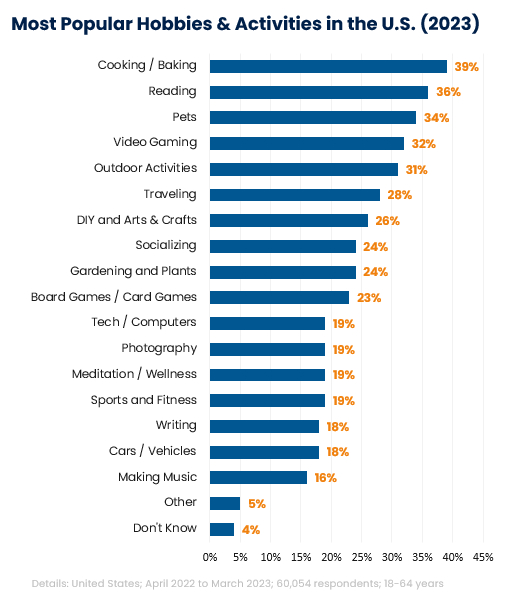

Not only can you help clients who devote their time and money to their favorite pastime, you can talk with clients who enjoy the same activities you do! Some dedicated hobbyists may need a financial plan to reach their leisure time goals, such as buying a boat or traveling to their favorite vineyard. Others hope to turn their hobby into a hustle, and you can help them create a plan to turn their dream into reality.

Other Groups

Demographic groups (such as gig economy workers) and business owners may have unique financial needs that can be complicated by quickly changing legislation. When you stay current with the financial landscape for your preferred market, your clients will appreciate your help in weighing the implications of their decisions.

Launching Your New Specialization

Once you’ve identified your niche, how do you find clients in your new field of expertise? It will take some time to establish yourself as an expert, but you can get started with these tips:

Educate Yourself

Learning about your target market helps you understand your clients and the service they need. This will be easier if you already serve clients who belong to your target group, but you can always benefit from learning more. Market research helps you understand your future clients’ financial needs.

A few questions to consider:

- What characteristics typically make up this group?

- What financial challenges and opportunities do they face?

- What goals and values are important to members of this group?

- What products or services could be helpful to them? Which of these is not typically offered by other advisors?

- What hours should you be available to be accessible to this group?

- What recent or pending legislation may impact this group’s financial future?

Meet Clients Where They Are

As you look for new clients, it’s important to introduce yourself to the community. You need to go where your future clients gather, whether that’s in person or online. You may not meet new clients immediately, but you can begin to establish relationships and learn more about the community as you show up in their favorite spaces.

A few ideas for finding your target market:

- Ask current clients for referrals and recommendations

- Visit shows and conferences

- Join associations

- Join online groups to learn what issues they are concerned about

Of course, these steps are just the beginning, but if you want to set yourself apart from the competition and become your clients’ trusted expert, the right niche market and a solid knowledge base will move your advising firm in the right direction.

When you specialize your financial advising services for a specific area and take advantage of Docupace’s document management software, you create an optimal customer experience that will keep your clients engaged with your firm.