“Advisors are dissatisfied with the way we handle paperwork. They call us a ‘black hole.’”

“That audit totally wrecked us. Paper books and records just aren’t doing it anymore.”

“I thought implementing this point solution would speed things up, but it’s just added another step to our workflow.”

“Advisors just don’t want to work with us when they find out we’re not paperless.”

This is what our broker-dealer clients sound like when we first talk to them on the phone. Either they’re stuck using outdated paper-based workflows, or they’ve tried to cobble something together with non-specific tools. In any case, they feel like they’re losing out to more organized, more efficient B-Ds.

Docupace paperless onboarding software helps these firms move their operations into the 21st century. The Docupace Platform is the only paperless onboarding solution on the market designed specifically for the wealth management industry, and the only one with SEC and FINRA compliance built in.

Docupace Creates Efficiency

The Docupace Platform makes it possible to transmit new client account paperwork directly and electronically from the advisor to the broker-dealer to the clearing house. Our software automatically checks the application for errors and compliance issues, virtually eliminating NIGOs.

Our paperless onboarding software makes it possible to reduce turnaround times on new account applications from days or weeks to minutes — but the benefits go way beyond saving time.

One large broker-dealer client turned to Docupace after experiencing continuing issues with advisor dissatisfaction. After implementing Docupace, they were able to reduce their back office staff by 20%, eliminate the mailroom, eliminate the call center, and use the extra cash to acquire four smaller broker-dealers.

Docupace Makes Advisors Happy

Broker-dealers that rely on paper processes often run into issues with their advisors. Fax systems typically lack transparency and can get backed up — then when advisors call to find out the status of their business, broker-dealers are left shrugging their shoulders.

Docupace paperless onboarding software eliminates the headaches that come along with fax and mail. In addition, it enables advisors to offer better service to their clients.

| “Preparation time for client meetings has been significantly reduced. Valuable time is no longer wasted printing and highlighting multiple copies of paperwork in advance. With Docupace, forms are easily retrieved, work items are completed, and the client’s signature is obtained, all during the meeting.” — Adam Pearce, The Legend Group |

Docupace also integrates with popular esign solutions like DocuSign and SIGNiX, making every-day processes more convenient for clients and advisors alike.

When advisors love their broker-dealer, they stay with them longer, do better work, and tell their colleagues about their experience.

| “We didn’t realize what an effective communication tool Docupace would be for us and [our broker-dealer]. If there is anything missing on a form, [the broker-dealer] is able to get back to us quickly instead of having the process drawn out.” — Elizabeth Ross, Integrated Financial Resources, Inc. |

Docupace Is Integrated with Important Systems

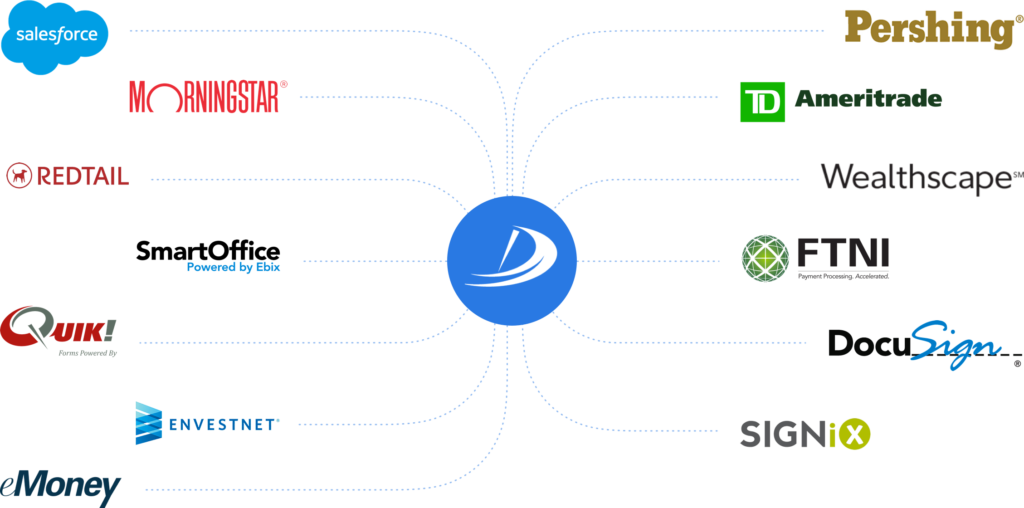

Docupace’s ecosystem of integrated products and firms goes way beyond esignatures.

The Docupace Platform is integrated with popular CRMs like Salesforce and Redtail, enabling advisors to pull in data on a client and pre-populate forms with important information, saving countless hours of manual data entry.

Docupace is also integrated with clearing houses like Pershing and TD Ameritrade, enabling broker-dealers to eliminate paper from end to end.

And that’s just the tip of the iceberg — Docupace also integrates with financial planning software, forms automation software, and more.

Docupace Comes with Expert Implementation and Support

At Docupace, we understand that implementing an entirely new technology solution isn’t like flipping a switch. That’s why we stand beside our clients through every step of a multi-phased implementation process. A Docupace implementation includes:

- Gap analysis — what’s different about your unique environment?

- Creation of a joint implementation plan

- Fast Start — delivery of major value within 30-45 days

- Delivery of supplementary value

Docupace clients have ownership over the platform. The standard delivery might get a firm 80% of the way toward maximum efficiency, and we’ll work together to accomplish that last 20%. In addition, clients can request new integrations and add more services as their appetite for technology grows.

We consider our relationship with a client to be a partnership. Each client has an assigned account manager who will check in frequently to ensure everything is running smoothly.

Broker-dealers love Docupace, and Docupace loves broker-dealers. Get on board with our paperless onboarding software and watch your business soar.