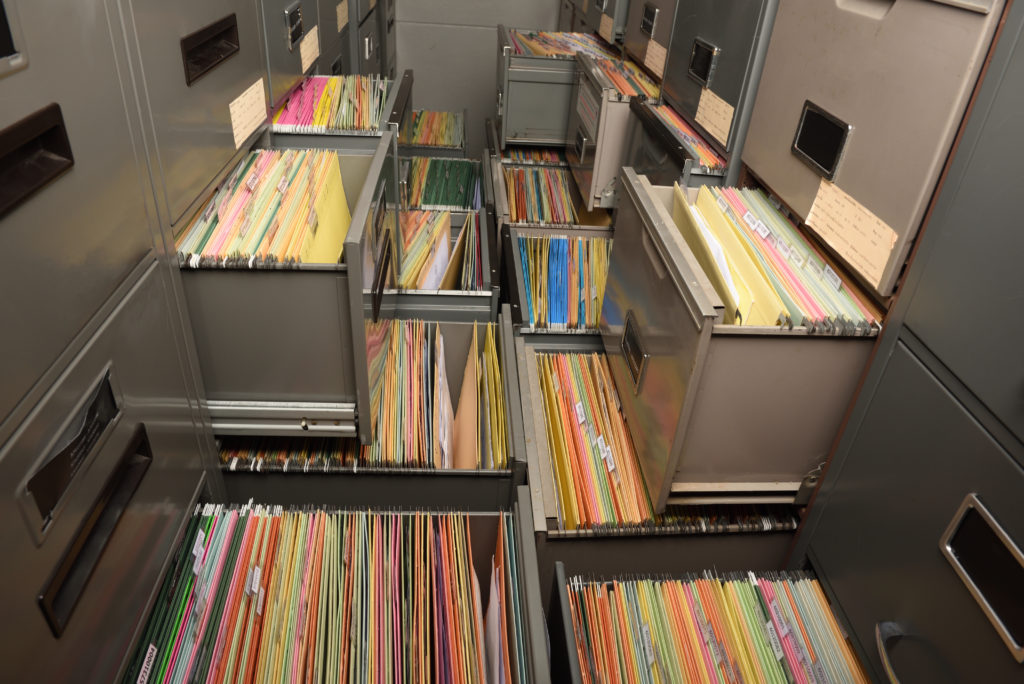

Physical paperwork is losing its luster for the financial industry. Not only is paperwork environmentally detrimental, but it also poses security threats, has high inaccuracy rates and is inconvenient and inefficient for both organizations and clients. If you haven’t digitized, it’s way past time to leave your bulky physical documents behind to create a more streamlined experience to benefit both clients and your firm.

Why Paper Poses Risk

Paperwork is not only inconvenient; it’s dangerous for businesses. Here are the top threats that physical paperwork poses to a firm and the opportunities in digitization.

Paperwork Busts the Bottomline

While firms have historically considered associated costs of producing, warehousing and destroying financial paperwork “business as usual” overhead costs, they account for a significant financial burden. For example, a large retail bank streamlined its process and incorporated technology to eliminate paper reduced operating expenditures in its processing divisions by as much as 25%. How might some of these hidden costs affect your firm?

Hidden costs that affect your bottom line may include:

- Supply costs (paper, printing materials, etc.)

- Corporate office, storage and warehousing costs

- Destruction and security costs and time

- Administrative costs and time to organize and allocate paperwork

Digitization removes or minimizes many of these often-overlooked expenditures. While cybersecurity and cloud-based storage are also vulnerable to cyberattacks, with the proper cybersecurity measures in place (such as maintenance and encryption), digital records are easier for advisory firms to organize, track and search without the bulky cost overhead. Digital records also save time which, in turn, saves everyone money. Digitization also enables eSignatures, intelligent (automated) client onboarding and synchronous data so that turnaround times are immediate.

Security Solutions

With increased regulations, financial service providers will need to streamline their record management with increased transparency, near real-time reporting, and heightened security. The Treating Customers Fairly (TCF) and compliance standards, the Protection of Personal Information Bill (POPI), and the Consumer Protection Act (CPA) point toward trends for more customer-centric, transparent, and near real-time reporting.

Paper files aren’t up to that task. Paperwork is vulnerable to loss and damage and can’t leave a trail of who has access or views them or duplication that may take place. Deloitte’s analysis points out, “This is especially risky when unnecessary duplication takes place, especially where copies of information have already been obtained from clients during prior interactions.”

In contrast, digital documents can be immediately sorted, searched, and tracked so that clients are always prepared for an audit. They provide more transparency allowing both customers and firms instant access and reporting. Additionally, digital documents are not as vulnerable to damage or loss and provide an audit trail after each step of the process. Digital security also provides analytics tracking tampering and modification. All these tools ensure compliance requirements by verifying data and checking for compliance in near real time.

How to Manage Your Digital Environment

The digital environment has heightened expectations of transparency, accountability, ease and integration to streamline the client experience. Digitization of manual record management also provides more time and insight into understanding markets to create a customized and customer-centric experience.

Fully integrated software programs such as autofill logic through Docupace and Precise FP aggregate client data into customizable formats and provide valuable insight into clients’ behavior, financial preferences and the market. With these insights and automated data collection and entry, advisors can analyze and act on data best for their clients rather than spend time on manual data entry.

Intuitive, streamlined software reduces errors and repeated information, increases security and transparency, and frees up time for advisors to focus on more critical tasks. The right solution should also integrate easily with leading CRMs, portfolio management, and financial planning tools for streamlined end-to-end solutions.

If your firm wants to find better record management solutions, contact Docupace to learn more about the digital transformation journey.