A wave of change has arrived at the doorstep of the once sleepy financial services industry. Social media, artificial intelligence-based tools and the overall digital revolution has put pressure on the “old ways” and carries undeniable implications for the advisor/client dynamic – particularly when it comes to young investors.

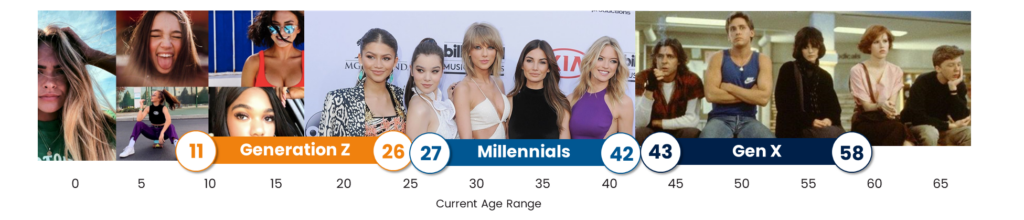

Well…they’re not really that young anymore. Some Gen Xer’s are approaching 60 and even some Millennials are now “over the hill”.

As these new generational cohorts seek out professional advice, they are bringing with them a plethora of expectations. A recent survey from Oracle found that customers’ top expectations include products and services that are enabled digitally in a retail-style experience. Among the highest-ranking expectations were:

- 49% simplicity/transparency

- 45% anytime, anywhere, any device access

- 43% robust cybersecurity

- 32% more innovative products

- 27% reduced fees

Reaching and Retaining Next-Generation Investors

I was recently a guest on The Flexible Advisor Podcast from FlexShares where I was able to speak with host Laura Gregg on insights from a recent Docupace whitepaper — Five Ways to Capitalize on the Changing Attitudes of American Investors. Our talk covered the needs, approaches, and attitudes of younger investors in today’s environment, and how best to engage, serve, and retain them as clients.

Our Conversation Covered:

- Why digitization and one-to-one planning and advice must co-exist

- Mistaken assumptions about Millennial and Gen Z investors

- 3 ways younger Investors think about money differently

- Using tech to elevate the advisor/client experience

- Key themes to drive acquisition and retention of next-gen clients

- And more

Listen below and reach out to see how Docupace can help reach and retain young investors.