There’s a big change coming in wealth management. We’re on the precipice of the biggest transfer of wealth in history, and most industry players are lagging behind consumer preferences.

You know the story; we’ve been talking about it for years. As baby boomers leave money to their children, financial advisors and broker-dealers must be prepared to meet changing investor expectations.

Younger investors are more tech-savvy, more engaged, and less likely to rely on traditional advisory practices than their parents. Millennial and Gen Z clients want a wealth management experience that’s highly interactive, where they can consume advice and direct their accounts using digital channels.

Unfortunately, a majority of broker-dealers and RIAs just can’t offer them what they want.

Waiting on the industry to change

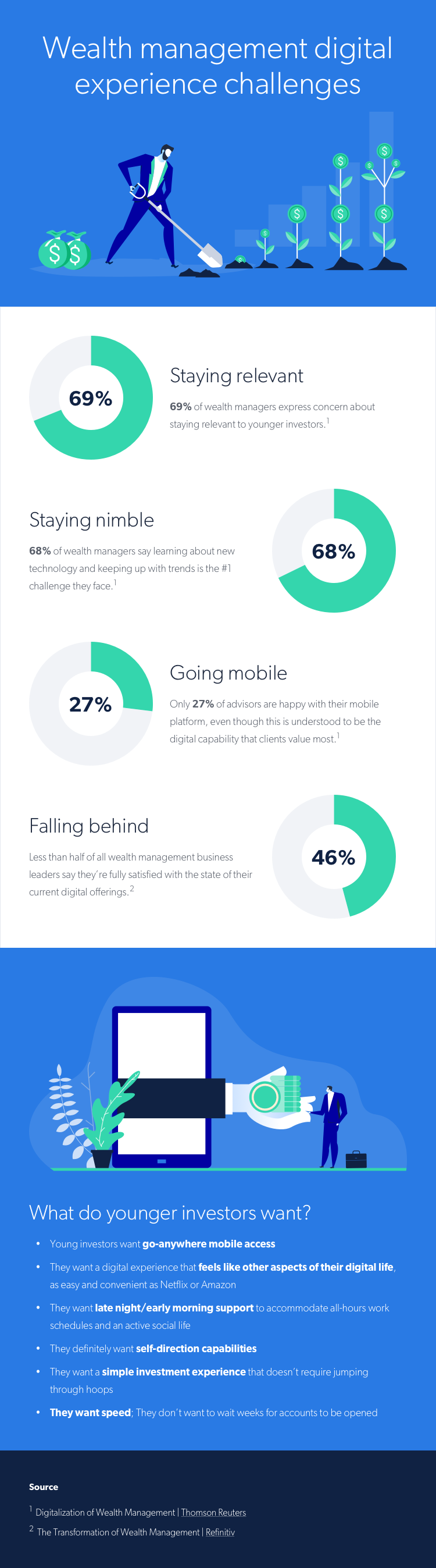

The wealth management digital experience is seriously lacking at most firms. That may sound like an unfair blanket statement, but the numbers speak for themselves.

The wealth management industry is aging

Wealth managers are concerned about staying relevant, and rightfully so. There is a growing gap between advisor and investor age cohorts, with only 11.7% of U.S. financial advisors under age 35.

At the same time, traditional advisory firms face increased competition from Silicon Valley, self-directed brokerage accounts, and robo-advisors. In the coming years, broker-dealers and RIAs must support advisors with seamless UX-focused digital experiences in order to compete with these challengers and retain their clients.

Easier said than done

There are many reasons why it’s been difficult to bring wealth management into the 21st century. Regulations that prevent firms from taking advantage of emerging technologies are a popular target of blame.

In addition, many smaller firms find that cost is a roadblock to digitization. Thin margins make finding capital to build a platform from scratch difficult. At the same time, firms that do implement digital processes often find that advisors (and back office employees) don’t use them to their full potential.

Of course, none of this matters to the end user, as a group of Deloitte analysts write very cogently in a recent report:

“Clients don’t see or care about the internal obstacles of legacy IT systems, cost-intensive regulatory compliance, or various other possible limitations to a digital transformation of the financial industry. All they might notice are, e.g., slow and inadequate user interfaces, a lot of personally irrelevant information, user-unfriendly support, inadequate services, or the lack of timely responses while being used to smarter solutions and approaches from other industries.”

In other words, firms have to start pushing digital experience through to their advisors by any means necessary if they want to stay competitive.

How we’re helping transform the industry

Docupace understands the challenges associated with digitization. We’ve helped leading wealth management firms implement digital operations to expedite account opening and create digital experiences that exceed client expectations.

For example, with Docupace Start, firms can create simple, branded, formless workflows to help advisors onboard new clients. Backed by paperless processing, SEC-compliant document management, and esignature tools, investors can open accounts in minutes, with no paperwork and no time-consuming errors.

Conclusion

As investor preferences change, so too will the role that advisors play in the wealth management ecosystem. Firms that drive digital experience to the core of the business will be in the best position to weather major shifts and stay competitive — for this generation and beyond.